In May 2021, US President Joe Biden came forward with a proposal for a global minimum tax. The proposal is very simple in principle, but will require compromises. The original American objectives have not been attained, but some interesting incentives did appear in the OECD Statement1 issued on 1 July 2021, meaning on the one hand, the assertion of American interests and, on the other hand, the downplaying of the OECD’s tax diplomacy successes to date.

Prosecutors to the global minimum tax

The concept of an internationally consolidated corporate income tax system is not new. That such a system is necessary is a result of international tax competition, the essence of which is that countries undercut one another in terms of corporate tax burdens, to attract as much multinational corporate activity as possible. While economic theory, taking a fundamentally normative approach, restricts itself to describing the issue of tax competition,2 international institutions promoting the integration of practice-oriented, developed countries see it as a harmful phenomenon.3 They argue that it not only results in the relocation of economic activities, but also leads to an opaque separation between income-generating activity and the income generated, as companies seek to minimize their tax burden. The international tax literature contains many such solutions, from the Double Irish to the Dutch Sandwich. Tax havens guarantee anonymity to the holders of offshore wealth and bank accounts, as well as to vehicles and property registered there.

The best-known economic model of a consolidated global tax is the so-called Tobin tax.4 This concept proposes a uniform, global tax on financial transactions, albeit primarily to pay for international financial assistance and development, rather than to secure public revenue. Taxation of financial transactions has not become commonplace, and where it has been introduced, especially in the 2010s, it has been used to augment domestic fiscal revenues, rather than to pay for international aid.

Another particularity of tax competition is that countries with asymmetric economic relations bid against one another with tax cuts, and it is typically smaller, lower-income and less developed countries that are best able to assert their interests.5 For the time being, due to national tax sovereignty, all countries can voluntarily decide whether to embrace tax competition or, through the OECD, attempt to negotiate international cooperation on tax. As a result, many small island states, microstates, and city-states have come to rely on revenue from their lax offshore taxation regimes. The OECD, apparently at the initiative of the largest and most developed economies, has been analysing international tax benefits for decades, and putting pressure on the countries that offer them. It defines several categories, including improving transparency and establishing effective exchange of information in tax matters,6 and, where necessary, names states as uncooperative tax havens.7 In addition, states offering tax benefits for international corporate income transfers, such as British and Dutch overseas territories, Singapore, Luxembourg, and Hungary, have all been included in OECD offshore analyses.

The EU is not only acting to apply pressure in international taxation, but is also seeking legal harmonization among member states

Based on the effective model of the single market, consumption taxes operate in a substantially uniform legal environment within EU member states. Moreover, these types of taxes (VAT, excise duties, energy and environmental taxes) also provide for a minimum tax, below which consumption and pollution taxes cannot be lowered. In this case, too, the purpose of the minimum tax is to ensure that it is not worthwhile for consumers to transfer a significant part of their consumption to neighbouring member states. Moreover, in the case of digital retail, the Community VAT Directive introduces turnover limits, which restrict the VAT benefits that can be exploited through webshops.9 The European Commission has also tried to harmonize corporate income tax (CIT) through the so-called common consolidated corporate tax base,10 but this did not win the support of member states in 2016. This initiative highlights the fundamental difference between corporate income taxes and consumption taxes. In the case of consumption taxes, there is no room for the international division and transfer of the tax base, as the tax base comprises product and service units. In the case of corporate income tax, on the other hand, the tax base is money, which is easy to divide and transfer, and is not closely tied to a specific business event. As a result, legislators have much more leeway in setting tax base adjustment parameters, which can mean greater rigour, but also significant relief.

International tax evasion is being facilitated by the increasing digitization of financial technologies and tax-based activities. Perhaps the best-known examples are the tax evasion practices of Google and similar online service providers, and the French attempt to tax the corporate income thus transferred. It is no coincidence that the challenges digitization poses have been at the centre of recent international tax disputes. Indeed, the aforementioned OECD Statement is entitled ‘Statement on a Two-Pillar Solution to Address the Tax Challenges Arising from the Digitization of the Economy’:

‘In-scope companies are the multinational enterprises (MNEs) with global turnover above 20 billion euros and profitability above 10 per cent […] with the turnover threshold to be reduced to 10 billion euros […]. Extractives and Regulated Financial Services are excluded. […] The minimum tax rate used for purposes of the IIR [Income Inclusion Rule] and UTPR [Undertaxed Payments Rule] will be at least 15 per cent.’12

The starting point for American economic policy and international tax diplomacy

The story began with the Biden government planning to base the financing of the economic recovery on tax increases.13 Part of this tax plan involves raising US corporate tax from 21 per cent to 28 per cent,14 which would obviously further incentivize large US corporations to take their profits and even production abroad, reversing the increasing employment rates seen under the previous presidency. To prevent this from happening, the original US proposal for OECD member countries was to set a minimum corporate income tax rate of 21 per cent. If we look only at the tax rates of the European states that make up the majority of OECD countries,15 this would indeed mean higher taxes in most EU member states.16 This is probably also due to the fact that the US minimum tax requirement is only 15 per cent. This rate would only interfere with the tax policy interests of Ireland (12.5 per cent) and Hungary (9 per cent). Both states, together with Estonia (20 per cent), have declared that they will not accept the tax increase and have opted out.17

The next weakness of the minimum tax proposal is that it was made among OECD countries, while the political justification President Biden gave for the proposal18 was that large US corporations do not pay tax on income generated in the US, but transfer it abroad, where they do not have to pay tax on that profit. However, the tax havens that are most harmful in this respect are located outside the OECD.19 In addition, the Minimum Tax Initiative downplays all that the OECD has already achieved in its fight against tax evasion, working with countries both inside and outside the group.

This is because the US tax shortfall is not only due to US companies using tax loopholes to transfer their profits abroad, but primarily to the fact that the Internal Revenue Service (IRS) cannot see this income, or foreign bank accounts and statements. If a tax authority can establish a taxpayer’s income, or that it was created within its jurisdiction, it can straightforwardly determine the tax liability, regardless of where a taxpaying US-based company parks its profits. Furthermore, in the case of corporate income earned from a country with a lower tax burden, US rules allow for the collection of the tax difference using a tax credit. This, of course, requires international reporting between public tax authorities and financial supervisors.

Through the so-called BEPS (Base Erosion and Profit Shifting)20 guidelines, the OECD’s efforts to date have sought to ensure that within the global space of fundamentally national tax sovereignty, states make transparent and accessible any tax information which may fall within the purview of another’s tax authorities. Partly as a result of this, Hungarian legislation has also adapted the IFRS financial reporting practice, and the OECD tax recommendations for controlled foreign companies. The BEPS Declaration has been signed by 139 countries, and these have since participated cooperatively, showing that a wide range of non-OECD countries has also been involved, leading to the removal of many offshore island countries from harmful tax haven blacklists. In the case of the OECD ‘Statement on the Global Minimum Tax’, seven countries that have previously joined the BEPS are missing from this list. Apart from the aforementioned Hungary, Ireland, and Estonia, these non-signatories are Nigeria, Sri Lanka, Barbados, and the Turks and Caicos Islands. The latter two may be familiar to anyone who has looked into offshore banking opportunities. The OECD Statement was also formulated as part of the comprehensive BEPS programme, but it is reasonable to ask whether the transparency efforts of BEPS will be undermined if a minimum tax rate which is easy to meet but barely representative of the actual tax burden is henceforth used as the measure for determining which countries are labelled tax havens.

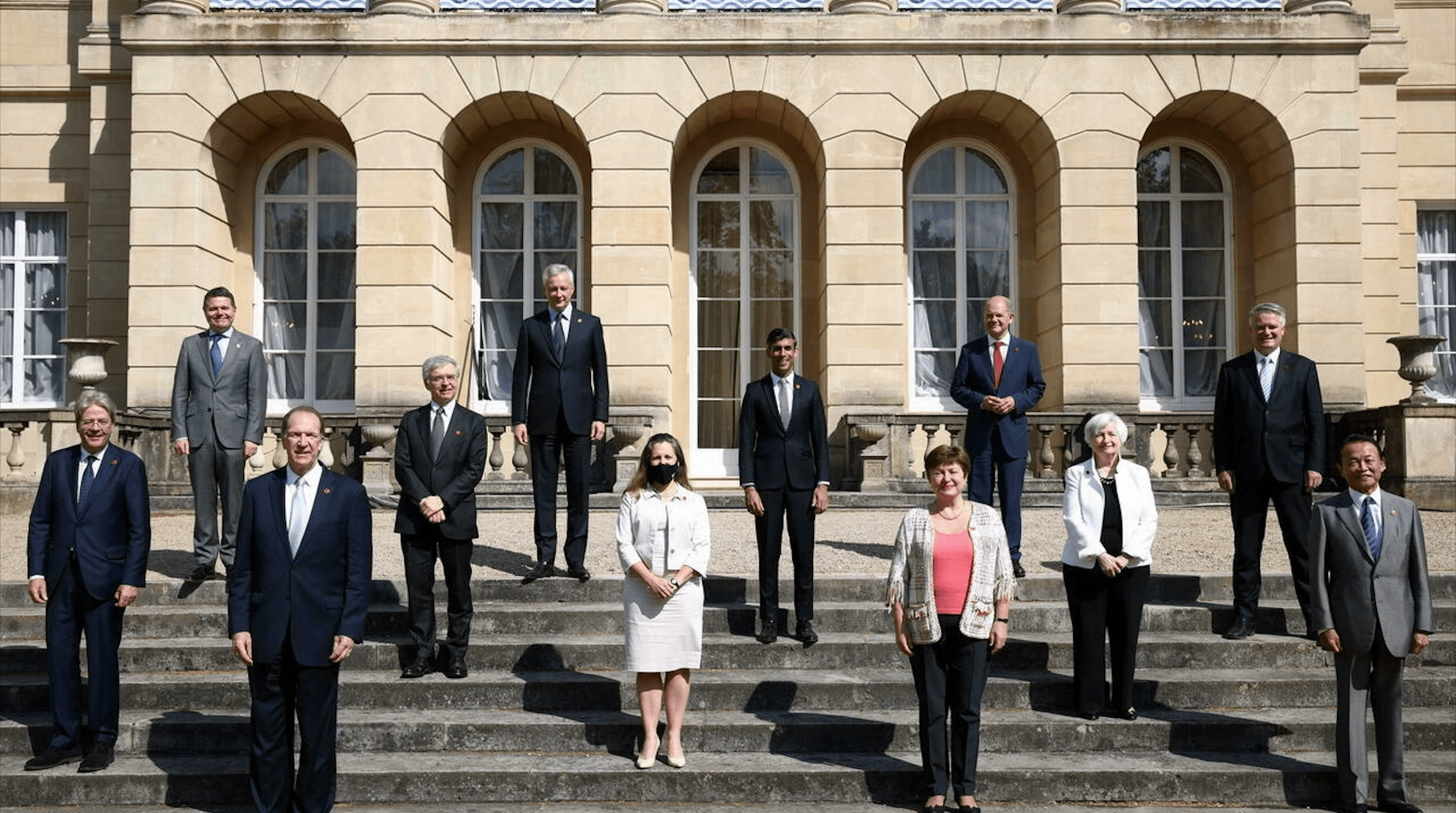

With regard to the US concession on the minimum tax, the question also arises as to whether, if the minimum tax is only above the tax level of a few OECD countries, the US proposal still makes sense. Can it still offset G7 Finance Ministers meeting. Lancaster House, London, 5 June 2021 the deterrent effect of a US tax increase if the difference between the US tax and the global minimum tax is not seven but thirteen percentage points? If Ireland, which truly is a tax haven for US companies, raises its corporate tax by 2.5 percentage points while the US raises its by seven, will US firms then want to tax their profits in the US through Irish offshore solutions?

It is not the tax rate that matters, but the tax base

While the proposal may appear politically appealing, what makes it professionally unsound is that the true tax burden of a company does not depend principally on the tax rate, but on the tax base calculation. It is no accident that in the European Union, the German and French corporate tax initiatives in 201221 and 201822 were both about harmonizing the tax base calculations, since agreeing on tax rates before harmonizing tax base calculations is ineffectual. Tax base reductions and tax credits can be used to offset the tax base burden on profits to any extent wished. The OECD statement of 1 July 2021 defers to a future date any precise definition of the tax base calculation, so this remains an open question. If no sovereign country is subsequently to be obliged to waive its own tax adjustment prerogatives, the convention will be irrelevant. If, on the other hand, the signatories to the convention are compelled to adopt a uniform method of calculating the corporate tax base, they may be walking into a trap.

The mismatch is well illustrated by the statistical data on the so-called effective tax rate

Calculations of the total, profit-adjusted tax burden on companies, including all forms of taxation, show that official tax rates and actual tax burdens differ considerably. This is especially true for companies that can still benefit from tax credit after investments, through the effective marginal tax rate.23 The 2019 data show that in the USA, as elsewhere, companies that reduce their profits through investment can expect their overall tax burden to be more than halved. In addition, the effective average tax rate data show that not only Hungary and Ireland, but many other countries including Poland, Romania, Bulgaria, Cyprus, and even Singapore, not to mention the classic tax havens, have actual tax burdens that are significantly lower than in the USA.

The OECD Statement leaves certain issues undecided. Most perilous of all is the declaration on the tax base, according to which the tax base will be determined at a later date:

‘The relevant measure of profit or loss of the in-scope MNE will be determined by reference to financial accounting income, with a smallnumber of adjustments. Losses will be carried forward.’24

The above sentence leaves open the question of determining the tax base. Obviously, this will be done in accordance with relevant OECD and IFRS rules, but for the time being the possibility remains that countries signing the Statement risk stepping into a tax sovereignty trap, being forced to give up certain tax base reductions, with a consequent detrimental effect on investment.

How can the US secure a 15 per cent minimum tax?

In addition to the issues left open by the OECD Statement, the wording of the text suggests that the USA can secure a favourable outcome on several other points, and expand its regulatory jurisdiction. The OECD Statement does not ignore American interests. Based on the following three sentences, it will be possible to extend the jurisdiction of the US (and other developed OECD or G20 countries) over corporate profits that were previously outside their control. The Statement explicitly affirms that above a certain profit margin, the CIT base of multinational companies can be allocated to the jurisdiction of the receiving market, and the company will be subject to a withholding tax on income where it has sold its products and services:

‘There will be a new special purpose nexus rule permitting allocation of Amount A [pre- tax income] to a market jurisdiction when the in-scope MNE derives at least 1 million euros in revenue from that jurisdiction. For smaller jurisdictions with a GDP lower than 40 billion euros, the nexus will be set at 250,000 euros. […] Revenue will be sourced to the end market jurisdictions where goods or services are used or consumed.’25

In addition, given that France and several other relevant EU member states have endorsed the OECD Statement, the following one-sentence paragraph is relevant:

‘Unilateral measures – This package will provide for appropriate coordination between the application of the new international tax rules and the removal of all Digital Service Taxes and other relevant similar measures on all companies.’26

The background to the paragraph is that the US has fundamental objections to the digital services taxes introduced by an increasing number of EU member states, which are mainly borne by international IT giants (Facebook, Google, Amazon, etc.) and which are largely a result of the corporate tax avoidance practices of the companies in question. This debate reveals a conflict of interest, as the US does want companies to pay their taxes, but at the same time looks askance at other countries which collect taxes on income generated by US companies in that jurisdiction. In the interpretation of the US, European digital service taxes are a market-distorting tool introduced against US technology companies, and it has not hesitated to respond in kind. In response to a French digital tax that entered effect on 1 January 2019, and also affected US technology giants, the US introduced a duty on French luxury goods in December 2019, worth a total of $2.4 billion. In June 2020, in continuation of this punitive customs policy, the Office of the US Trade Representative (USTR) recommended27 considering the possibility of imposing new 100 per cent duties on olives, coffee, beer, gin, bakery products, and lorries from France, Germany, Spain, and Britain. As a result of digital service taxes, the USTR has already begun to investigate Austrian, Czech, and Italian practices, as well as those of several other, non-EU countries.28 It has been observed that the proposal alone has already had a significant impact on the share price of European companies.29 The penalty does not affect the EU as a whole, but the products of individual countries. Thus, US customs policy does not necessarily treat the EU as a single unity. However, with the EU suggesting the introduction of a digital tax to cover the coronavirus crisis recovery economic package, it may also become subject to punitive measures as part of US trade policy.30

WAS IT WORTH OPTING OUT?

For the US, the announcement served primarily as a domestic policy statement, and a wording that served US (and G20) interests was successfully smuggled into the OECD Statement. Meanwhile, a number of OECD and non-OECD countries with corporate tax rates above 15 per cent have announced their endorsement of the initiative. Incidentally, this symbolically supports the 2018 Franco-German corporate tax harmonization efforts within the EU. It is likely that key European countries have been compensated in other areas as well. For example, the US is no longer opposed to the commissioning of the Nord Stream 2 Russian–German gas pipeline,31 which was formerly a contentious issue in US–European economic diplomacy. As outlined above, those highly developed countries which have so far been leading efforts to combat the challenge of tax evasion, including the US, may extend their jurisdiction to the foreign profits of their multinational corporations. The US and other major G20 countries, as the world’s largest markets, have established the right to tax profits on goods and services sold on domestic markets vis-à-vis other signatory countries. Likewise, the US can exempt big tech companies from European digital service taxes.

The fact that the method of calculating the tax base is treated as an open question by the OECD Statement may pose a future risk for signatories. The Irish and Hungarian governments, which have set a tax rate below 15 per cent, are unambiguously opting out of the convention, but it is notable that even Estonia, which has a higher tax rate, seems unwilling to share jurisdiction over profits, or to sign a blank check for an undetermined and uncertain tax base. Thus, it can be stated that it is not primarily the tax rate, but rather the issues and determinations left open by the OECD Statement, which would jeopardize the effectiveness of Hungarian tax policy, since it seeks to attract foreign companies through investment and development tax incentives, which, combined with a low official tax rate, significantly reduce the effective tax burden on MNEs engaged in production and development.

Although the tax burden is not the primary consideration when choosing a company location, it is certainly a competitive advantage within the Central and Eastern European region. Not to mention that dividends paid abroad are not subject to a withholding tax in Hungary. In Hungary’s case, the goal is clearly not to become a haven for offshore tax revenue, but to encourage actual economic activity in order to create jobs, stimulate further high-value-added production, and increase income. Basically, Hungary’s accession to the OECD Statement would not only undermine tax sovereignty, but also its overall development and growth strategy. At the same time, Hungary continues to participate in all other elements of the BEPS, which ensures transparency, data sharing with the tax authorities of foreign partners, the enforcement of the arm’s length principle, the verifiability of the tax base allocation of controlled foreign companies, and so on. Hungary’s accession to the Global Minimum Tax Statement would not be a positive-sum, win-win outcome, but merely the enforcement of US interests and a degradation of Hungary’s ability to attract capital. Based on all these factors, the best course for Hungary is to opt out for the present, and to wait for developments in the still-open question of the tax base. At that point, a decision can be made as to whether accession to the convention would not entail sacrificing competitiveness, and whether the favourable effective tax burden for MNEs operating in Hungary can be maintained with tax base changes.

Translated by Thomas Sneddon

NOTES

1 OECD, ‘Statement on a Two-Pillar Solution to Address the Tax Challenges Arising from the Digitization of the Economy’ (1 July 2021), https://www.oecd.org/tax/ beps/statement-on-a-two-pillar-solution-to-address-the- tax-challenges-arising-from-the-digitalisation-of-the- economy-july-2021.pdf.

2 Helmuth Cremer and Pierre Pestieau, ‘Chapter 57—Factor Mobility and Redistribution’, Handbook of Regional and Urban Economics, Vol. 4 (Elsevier, 2004); Michael Keen and Kai A. Konrad, ‘Chapter 5—The Theory of International Tax Competition and Coordination’, Handbook of Public Economics, Vol. 5 (2013).

3 OECD, Harmful Tax Competition. An Emerging Global Issue (1998), https://www.oecd-ilibrary.org/ taxation/harmful-tax-competition_9789264162945- en; European Parliament, ‘Tax Competition in the European Union’, Directorate-General for Research Working Papers, ECON-105, https://www.europarl. europa.eu/workingpapers/econ/pdf/105_en.pdf.

4 James Tobin, ‘A Proposal for International Monetary Reform’, Eastern Economic Journal, 4/3–4 (1978), 153–159.

5 Céline Azémar, Rodolphe Desbordes and Ian Wooton, ‘Is International Tax Competition Only about Taxes? A Market-based Perspective’, Journal of Comparative Economics, 48/4 (Elsevier, 2020), 891–912, doi: 10.1016/j.jce.2020.05.002.

6 https://www.oecd.org/countries/caymanislands/ jurisdictions-committed-to-improving-transparency- and-establishing-effective-exchange-of-information-in- tax-matters.htm.

7 https://www.oecd.org/ctp/harmful/ theoecdissuesthelistofunco-operativetaxhavens.htm.

8 https://taxjustice.net/press/tax-haven-ranking-shows- countries-setting-global-tax-rules-do-most-to-help- firms-bend-them/. https://www.oecd.org/newsroom/hungary-deepens- commitment-to-fight-offshore-tax-avoidance-and- evasion.htm.

9 Council Directive 2006/112/EC, https://eur-lex. europa.eu/legal-content/EN/ALL/?uri=celexper cent3A32006L0112.

10 https://ec.europa.eu/taxation_customs/common- consolidated-corporate-tax-base-ccctb_en.

11 Nicolo Zingales and Luca Belli, ‘Platform Value(s):

A Multidimensional Framework for Online Responsibility’ (16 November 2019), SSRN: https://ssrn. com/abstract=3488282 or http://dx.doi.org/10.2139/ ssrn.3488282.

12 OECD, ‘Statement on a Two-Pillar Solution’.

13 Michelle P. Scott, ‘Biden’s Tax Plan: What’s Enacted, What’s Proposed’ (19 April 2021), https://www. investopedia.com/explaining-biden-s-tax-plan-5080766.

14 Alan Rappeport, ‘US Backs 15 Per Cent Global Minimum Tax to Curb Profit Shifting Overseas’, The New York Times (20 May 2021), https://www.nytimes. com/2021/05/20/business/economy/global-minimum- tax-corporations.html.

15 https://home.kpmg/nz/en/home/services/tax/tax- tools-and-resources/tax-rates-online/corporate-tax- rates-table.html.

16 https://taxfoundation.org/2021-corporate-tax-rates-in-europe/.

17 ‘Ireland, Hungary and Estonia Opt out of OECD Tax Deal and Cast Shadow over EU’s Unified Position’, Euronews (2 June 2021), https://www.euronews. com/2021/07/02/ireland-hungary-and-estonia-opt-out- of-oecd-tax-deal-and-cast-shadow-over-eu-s-unified-pos.

18 Joseph Zeballos-Roig, ‘Biden Says He Wants a 28 Per Cent Corporate Tax Rate Because He’s “Sick and Tired of Ordinary People Being Fleeced”’, Business Insider (7 April 2021), https://www.businessinsider.com/ biden-corporate-tax-hike-infrastructure-big-companies- average-americans-2021-4.

19 Raluca Enache, Cayman Islands and Oman Delisted, Barbados and Anguilla Added to the EU List of Non- cooperative Jurisdictions. Council—Code of Conduct Group—Harmful Tax Regimes—EU Blacklist—Tax Transparency (2020), https://home.kpmg/xx/en/home/ insights/2020/10/etf-435-eu-blacklist-update.html.20 https://www.oecd.org/tax/beps/beps-actions/.

21 ‘Paris, Berlin to Unveil Joint Corporate Tax Plan at Ecofin’, Euractive (20 February 2012), https://www. euractiv.com/section/euro-finance/news/paris-berlin-to- unveil-joint-corporate-tax-plan-at-ecofin/.

22 Bundesfinanzministerium, ‘German–French Common Position Paper on CCCTB’ (2018), https:// www.bundesfinanzministerium.de/Content/EN/ Standardartikel/Topics/Europe/Articles/2018-06-20- Meseberg-att2.pdf?__blob=publicationFile&v=3.

23 OECD Statistics, https://stats.oecd.org/Index. aspx?DataSetCode=CTS_ETR.

24 OECD, ‘Statement on a Two-Pillar Solution’.

25 OECD, ‘Statement on a Two-Pillar Solution’.

26 OECD, ‘Statement on a Two-Pillar Solution’.

27 USTR, ‘Section 301 Investigation’, Docket No. USTR–2020–0023.

28 USTR, ‘Section 301 Investigation’, https://ustr.gov/ issue-areas/enforcement/section-301-investigations/ section-301-digital-services-taxes.

29 USTR, FACT SHEET: The President’s 2020 Trade Agenda and Annual Report (Office of the United

States Trade Representative, 28 February 2020); Reid Whitten and Sarah Ben-Moussa, ‘A Trade War on

Two Fronts: US Considers More Tariffs on European Goods’, Global Trade Law Blog (2020), https://www. globaltradelawblog.com/2020/07/02/tariffs-european- goods-ustr/.

30 USTR, ‘Section 301 Investigation’, Docket No. USTR–2020–0022.

31 Simon Lewis and Andrea Shalal, ‘US, Germany Strike Nord Stream 2 Pipeline Deal to Push Back on Russian “Aggression”’, Reuters (22 July 2021), https:// www.reuters.com/business/energy/us-germany-deal- nord-stream-2-pipeline-draws-ire-lawmakers-both- countries-2021-07-21.