The government is committed to protecting families, which is why it aims to encourage and assist individuals in maintaining the value of their savings amidst sanction-driven inflation, highlighted the Ministry of Economic Development (GFM) in its Wednesday statement.

The more than 7 trillion forints worth of non-invested financial assets held in personal current accounts could mean a significant loss of income for account holders in the current inflationary environment. Therefore, the government decided to introduce a four-part measures package, to reduce government interest expenditures and improve its self-financing capability, while also preserving the real value of citizens’ savings. Two of the four measures aim to divert personal savings towards government bonds, while the other two increase demand for government bonds among banks and investment funds.

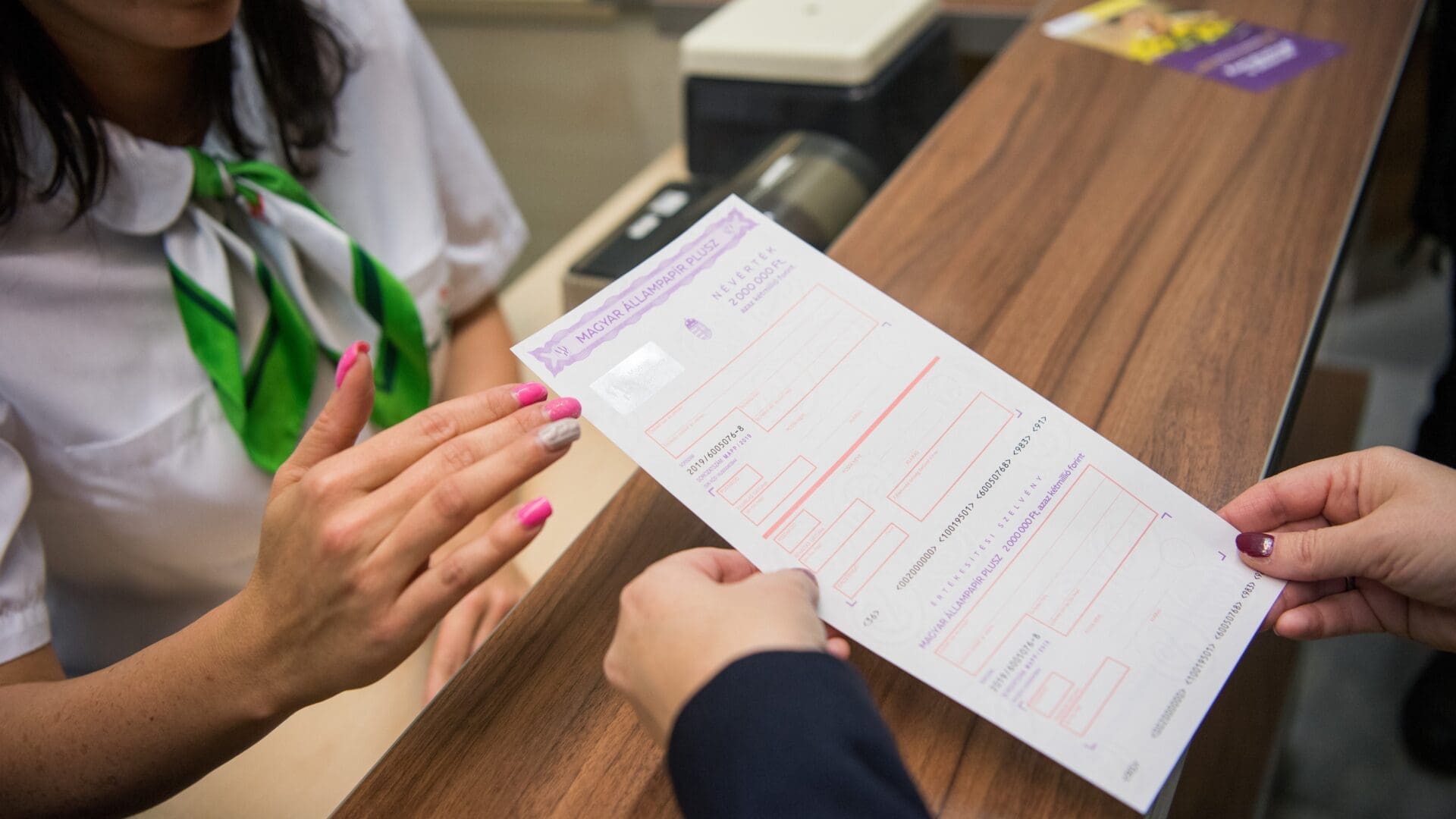

As far as citizens are concerned, the government introduced a regulation that compels banks to inform their clients about investment opportunities related to government bonds, demonstrating how much additional interest revenue clients could have earned over the course of a year if the individuals had held their savings in various government bonds instead of a current account.

As a second measure, the GFM recalls that, to make tax-free government bonds even more attractive, starting 1 July 2023, a 13 per cent social contribution tax payment obligation is imposed on financial instruments subject to interest tax, in addition to the interest tax. As for institutional players, the government provides banks with the opportunity to reduce their extra-profit tax obligations if the organisations increase their long-term government bond holdings.

Finally, for investment funds, the government expects that, in terms of the proportion of assets held in equity funds, the share of bonds should reach 60 per cent, and up to five per cent of the assets should be invested in securities denominated in Hungarian forints that represent credit relationships different from government bonds. Additionally, within liquid assets, the share of Discount Treasury Bills (DKJ) should reach 20 per cent in the case of securities and real estate funds.

Based on the currently available data, since the introduction of the measures, several remarkable results have been observed in the government bond market and the savings market. As a result of these measures, the volume of bank deposits has significantly decreased, and these amounts have flowed into bond funds and government bonds. Due to the effects of the measures, there has been considerable demand for government bonds at auctions in recent months, resulting in the DKJ’s excess issuance reaching 280 billion forints by the end of July 2023. In just one month, in June, investment funds increased their government bond holdings by nearly 320 billion forints.

The GFM emphasised that during this time, foreigners reduced their Hungarian government bond holdings by nearly 70 billion forints, which strengthened self-financing. Before the introduction of the measures, within the assets of bond funds, which are considered the most significant investment fund category, the proportion of bonds was around 45 per cent within bond funds, mainly due to the high deposit holdings. This proportion has risen to almost 60 per cent due to significant government bond purchases.

The significant growth of the government bond portfolio has been witnessed not only in investment funds but also among individual consumers. In June 2023, the population reduced their low-yield forint deposits by 275 billion forints, while increasing their government bond holdings by a similar extent.

Overall, the GFM said, the increased demand for government bonds has both directly and indirectly improved the government’s self-financing capability, reduced government interest expenditures, and managed to preserve the real value of citizens’ savings. Additionally, government measures have contributed to the fact that individuals are making more conscious decisions about their savings, turning towards higher-yielding assets in a high yield environment. The government continues to encourage citizens to inform themselves and place their savings in investments that retain their value, the GFM concluded.

Related articles:

Source: Hungarian Conservative/GFM/MTI