A recent survey by the Youth Research Institute shows that the majority of young Hungarians aged 25–39 have been trying to cut costs, most notably energy consumption, as a result of inflation, and most have also been attempting to save money on their shopping. Although they feel the impact of price rises on their generation as a whole, the majority is able to cope, with six out of ten respondents even managing to put money aside, at least occasionally.

In his annual State of the Nation speech, the Prime Minister cited inflation as the main problem, alongside the war, which is a major burden for families and indeed the past months have once again made rising prices a daily experience. While inflation rates had been hovering around two to three per cent over the past decade, in January 2023, year-on-year inflation was over 25 per cent, a shock for the economy and consumers. The price spike started with a rise in energy prices, quickly followed by an uptick in food prices. Forecasts predict a gradual reduction in the rate of monetary deterioration this year, with the National Bank of Hungary expecting inflation to return to the central bank’s tolerance band in 2024.[1]

The representative survey of young adults’ perceptions of inflation and their reactions to the economic situation was conducted by the Youth Research Institute in early 2023.[2] Young adults aged 25–39 were included in the sample because this is typically the age group that has already established an independent existence or is at the stage of life where separation from parents is occurring. This is typically the decade and a half in which many young people reach the highest level of education, move away from their parents, start their own family, and have children, making it a very intense and economically sensitive period in their lives.

The survey found that the majority of young adults in Hungary (aged 25–39) are married (42 per cent), or live in a cohabiting relationship (28 per cent) in their own household, meaning that they are also burdened with the cost of living. The vast majority (90 per cent) are also active in the labour market in terms of their primary activity, so the conditions for financing their costs are in principle given.

The majority perceives the deterioration of the financial situation in recent months in Hungary as worse or similar to that in neighbouring countries. One in two young people aged 25–39 surveyed thinks that the price rise in recent months has affected Hungary more than neighbouring countries, with a further four-tenths (42 per cent) believing that it has had an equal impact, while nearly a tenth (eight per cent) think that the exposure of neighbouring countries is more significant. Price rises have prompted many to cut back on their spending and start saving, and this is no different for young adults.

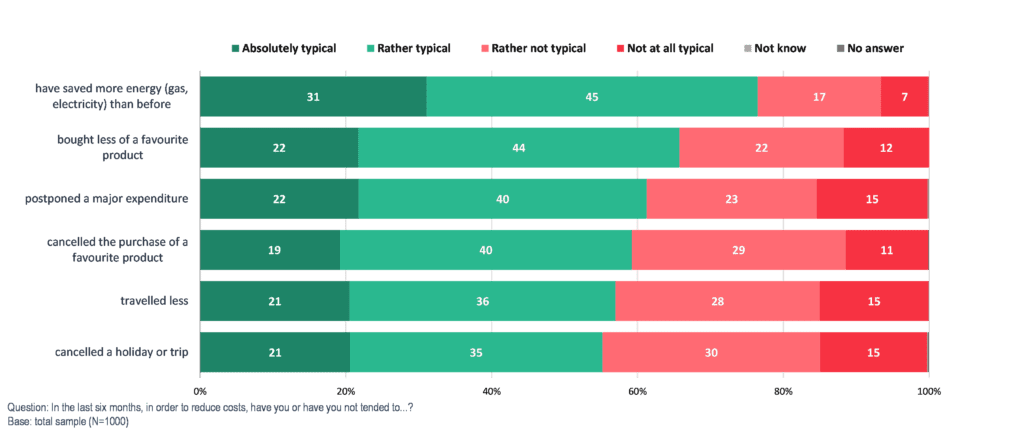

The survey also shows that the majority of young adults have tried to cut back on spending in some way. The most common behaviour is to save energy (gas, electricity) in order to reduce costs, with over three-quarters (76 per cent) of young adults saying they have cut back on energy consumption over the past six months. A majority of 25–39-year-olds also reported that they have been buying less of a product they liked (66 per cent) or have given up buying a product of their preference (59 per cent), a significant proportion has postponed a major expenditure (61 per cent), cancelled a holiday or trip (55 per cent) or travelled less (57 per cent). The slowdown in consumption is also confirmed by data from the Hungarian Central Statistical Office, which reported in February that the volume of retail sales in December 2022, adjusted for the calendar effect, fell by 3.9 per cent compared to the same period of the previous year.[3]

In general, the steps taken to contain costs vary according to the respondents socioeconomic situation. Saving is more pronounced among women, with differences of a few percentage points in general. However, a difference of up to ten percentage points is observed for those who have stopped buying a favourite product. In addition to women, those with a lower level of education are also more likely to cut back on expenditure, especially in cases where the reduction of energy consumption is not involved. While there is little difference in terms of levels of educational attainment, three-quarters (74 per cent) of those without a secondary school certificate, two-thirds (65 per cent) of those with a secondary school certificate, and 57 per cent of those with a degree have made a cost-cutting decision, with less than half (48 per cent) of graduates having given up a favourite product. As with educational attainment, there is also some difference depending on the size of the settlements where respondents live. The smaller the municipality, the more likely young adults are to save in some way. Among the regions, the Southern Great Plain stands out, where cost-cutting is more prevalent in all areas.

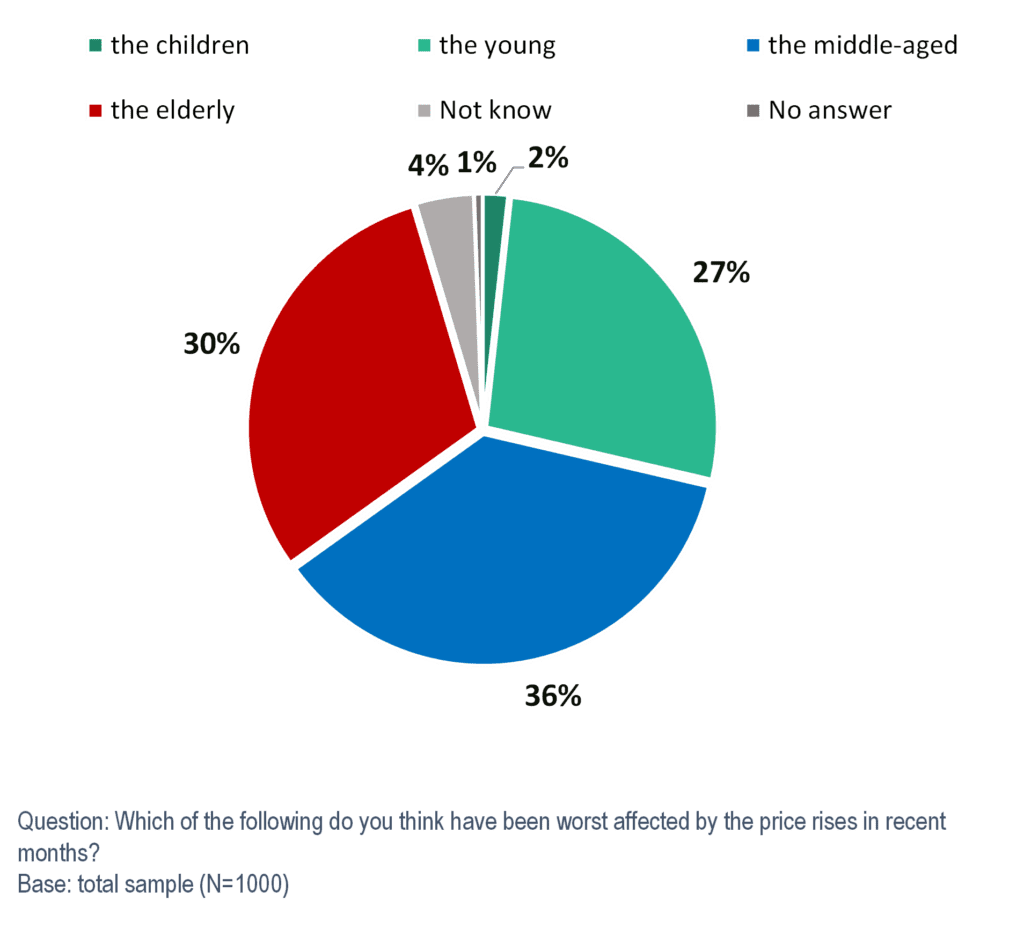

When looking at age groups, 25–29-year-olds and 35–39-year-olds tend to save more, while 30–34-year-olds save less. In other respects, two-thirds of young adults (67 per cent) feel that price rises are affecting their age group equally, i.e. they are being hit in a similar way to their peers. Among those who perceive a difference, slightly more feel that they are more affected by inflation compared to their peers than those who think that their age group is more affected by price rises and that they themselves are less affected (20 vs. one per cent). Among the generations, middle-aged and older people are perceived to be more affected. However, there are significant differences, with those under 30 citing young people as being affected by inflation at a ten percent higher rate than those over 30 (34 vs. 24 per cent).

A good number of young adults aged 25–39 already experienced the consequences of the global economic crisis of 2008 as adults. This experience remains vivid in their memories and is perhaps also the source of the common strategy of cost containment. The rapid reaction is only partly a matter of necessity: it is also of a conscious strategy of saving, which suggests that, despite the price rises experienced and the widespread use of cost-cutting strategies, the financial situation of young adults in Hungary cannot be considered bad. Their relatively favourable subjective material situation is also due to the positive developments of the last decade, characterised by declining unemployment and improving material conditions.

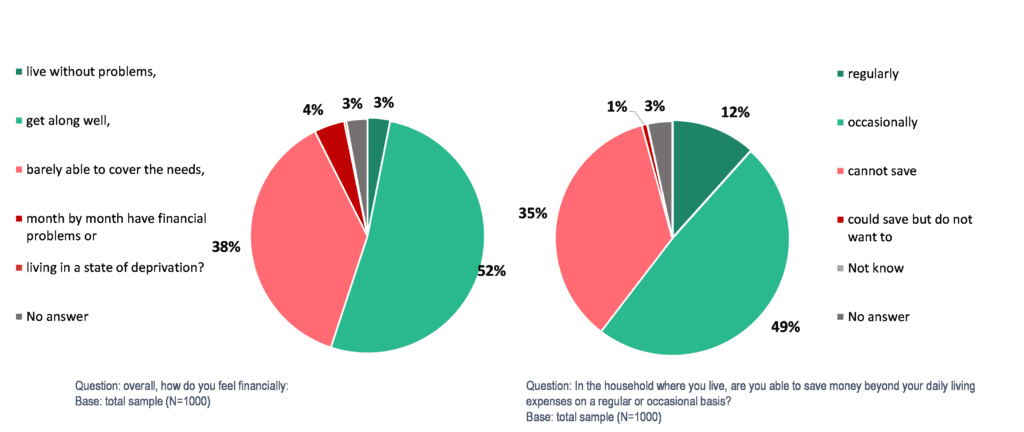

The relative well-being of young adults is reflected in the fact that in the current inflationary environment, more than half (52 per cent) said they are able to live well on their income, with a further three per cent living without any financial worries. Nearly four-tenths of respondents (38 per cent) are just about making ends meet, while five per cent are living amid financial hardship or deprivation. The relative well-being of young adults is also shown by the fact that half (49 per cent) of young adult households are able to put money aside from their income on a regular basis, and over a tenth (12 per cent) are able to do so occasionally.

[1] https://www.mnb.hu/letoltes/ir-infografika-2022-12.pdf

[2] The survey was conducted by interviewing 1000 people face-to-face (TAPI) between December 2022 and January 2023 on a representative sample of 25–39-year-olds in Hungary.

[3] https://www.ksh.hu/docs/hun/xftp/gyor/kis/kis2212.html