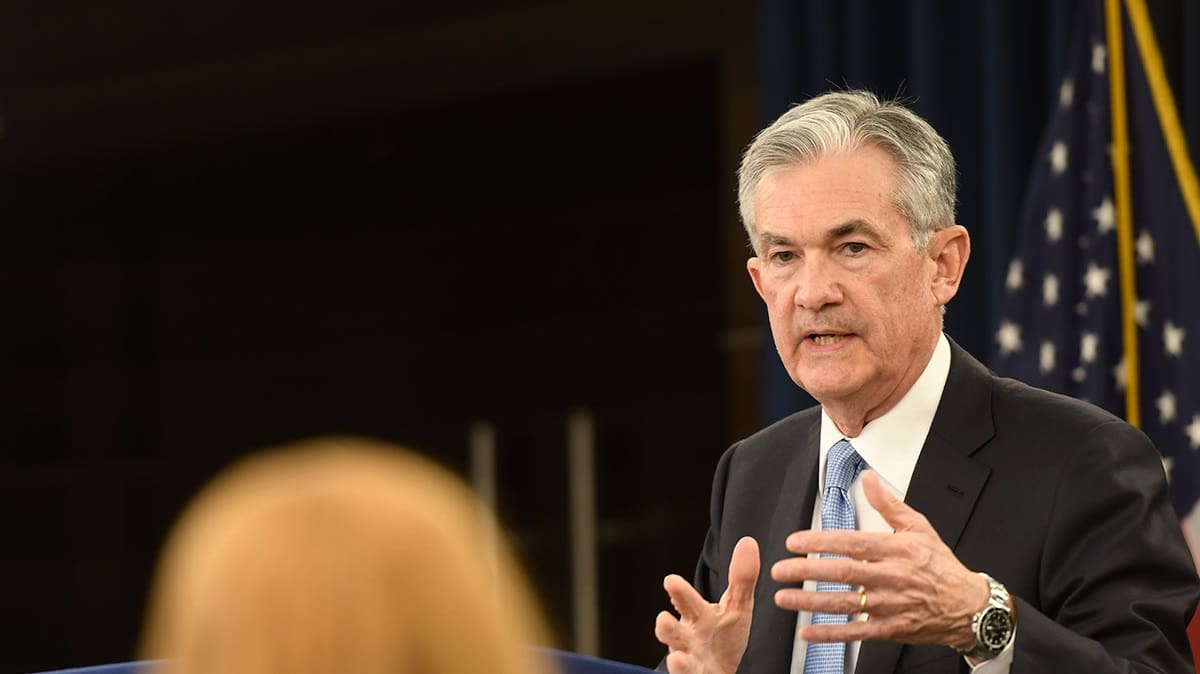

The Federal Reserve just held the first of its eight annual meetings on 31 January 2024, and they did not bring good news to traders or the average American. Chairman Jerome Powell announced that the Fed is not cutting the federal interest rate, and is keeping it at 5.5 per cent, the highest it has been since the early 2000s.

What is even worse news for investors is that he also stated that the central banking system is unlikely to cut the rates even in March,

something speculators were counting on.

As Chairman Powell put it: ‘We don’t have a growth mandate. We have a maximum employment mandate and a price stability mandate,’ meaning the Fed is willing to see stock market losses in exchange for a ‘sustainable path down’ to an inflation rate of two per cent.

Accordingly, markets dived upon the news breaking. The DOW Jones Industrial Average lost 0.82 per cent of its value on the day, while the S&P 500 and the NASDAQ composite were down 1.61 per cent and 2.23 per cent, respectively, at closing.

The US markets were able to recover in 2023 after the losses endured in 2022. In 2022, the DOW was down 8.78 per cent year-on-year, and the S&P 500 was down 19.44 per cent. Meanwhile,the NASDAQ (which comprises the biggest tech stocks, thus was the most vulnerable to the infection-induced rate hikes) lost nearly a third of its value, and ended the year with a 33.03-per-cent loss.

In 2023, the markets did bounce back, with the DOW gaining 13.74 per cent, the S&P 500 gaining 24.73 per cent, and the NASDAQ gaining a whopping 44.52 per cent.

However, that recovery was not as smooth as some people like to claim.

As recently as 27 October 2023, the DOW was down year-to-date. Most of the growth we see in the markets is from a three-month period, and, as we have just seen, is not necessarily sustainable.

Also, that still averages an annual return of 2.48 per cent for the DOW and 5.29 per cent for the S&P 500, not a stellar performance for those who have their retirement funds invested in either of these index funds.

Over the course of the three years that have passed since President Biden took office,

the DOW averaged an annual return of 7.9 per cent. Meanwhile, under President Trump’s four years in office, it averaged 12.36 per cent,

with a global pandemic breaking out in the last year.

Markets already took a big dip earlier this month, when the Personal Consumption Expenditures (PCE) report showed an increase of 0.2 per cent for December 2023, an unexpected uptick after it decreased by 0.1 per cent in November. However, stock prices were able to recover by the end of the month then, something that is less likely to happen now until federal interest rate cuts are actually announced.

President Biden likes to tout the low unemployment rate under his presidency, which is at just 3.7 per cent as of now, and has consistently stayed under four per cent for a long time. However, what is peculiar about those numbers is that in the meantime, the US labour force participation rate has still failed to come back to its pre-pandemic levels.

In February 2020, it stood at 63.4 per cent. Meanwhile, in December 2023, it is at 62.5 per cent.

Hungary Cuts Interest Rates

Meanwhile in Hungary, the National Bank already started the rate cuts back in October last year. However, it has also raised their benchmark rate to more than twice to that of in the US, 13 per cent. The same day as the most recent US Federal Reserve meeting, on 31 January, the Hungarian central bank issued its fourth consecutive rate cut in a row, and it is now down to 10 per cent.

The European Conservative on Twitter: “Euros & Dollars: Hungary’s Central Bank Cuts Interest RatesIn a bold move, the central bank @MNB_Hungary just cut its interest rates. Good thing #Hungary is not part of the #EuroZone:https://t.co/OLKPauKqqT / Twitter”

Euros & Dollars: Hungary’s Central Bank Cuts Interest RatesIn a bold move, the central bank @MNB_Hungary just cut its interest rates. Good thing #Hungary is not part of the #EuroZone:https://t.co/OLKPauKqqT

Cutting central bank interest rates is great help for people who want to take out a mortgage or a business loan, and it also encourages investment into businesses. However, if overdone, it leads to high inflation.

Related articles: